Bagley Risk Management : Securing Your Business Future

Bagley Risk Management : Securing Your Business Future

Blog Article

Just How Livestock Threat Security (LRP) Insurance Policy Can Protect Your Animals Investment

Animals Danger Security (LRP) insurance policy stands as a trusted shield versus the unpredictable nature of the market, providing a strategic technique to protecting your properties. By delving right into the ins and outs of LRP insurance and its diverse benefits, animals manufacturers can strengthen their investments with a layer of safety and security that transcends market variations.

Understanding Animals Threat Protection (LRP) Insurance

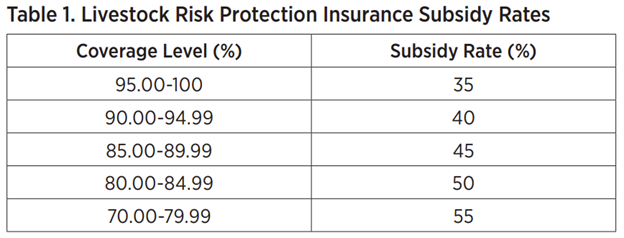

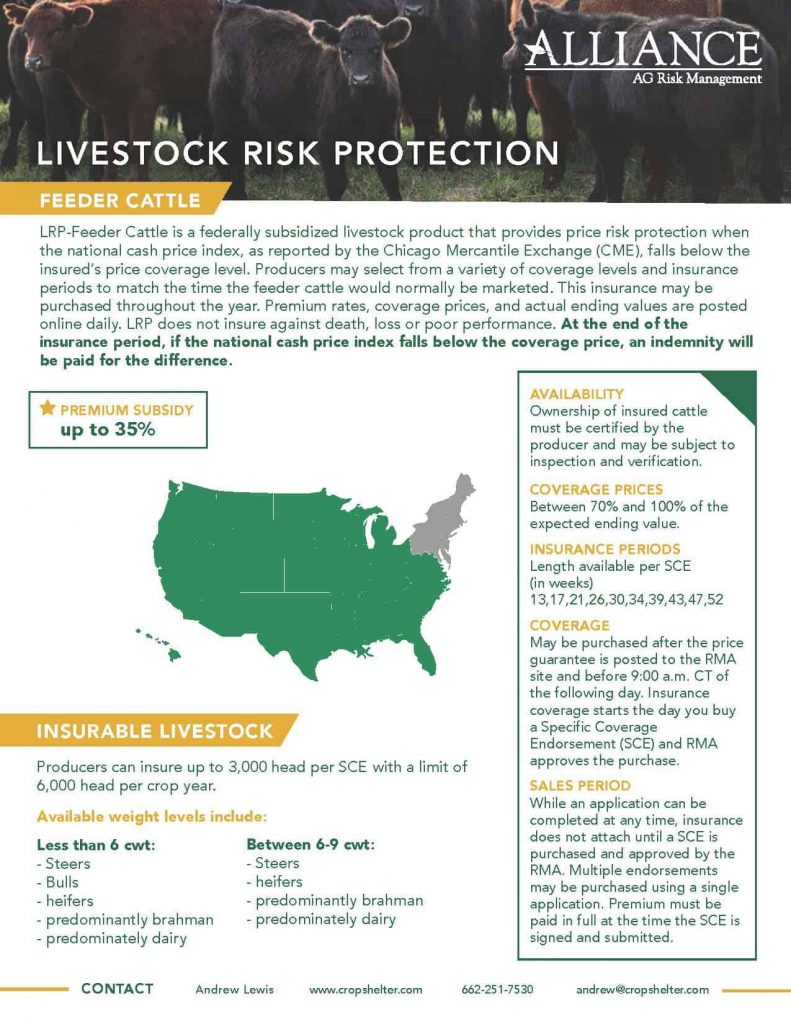

Comprehending Livestock Danger Defense (LRP) Insurance is important for animals manufacturers seeking to alleviate financial dangers related to price fluctuations. LRP is a federally subsidized insurance policy item developed to secure producers against a drop in market rates. By giving coverage for market rate decreases, LRP assists manufacturers secure in a floor rate for their livestock, making certain a minimal degree of income no matter market variations.

One key element of LRP is its versatility, enabling producers to customize insurance coverage levels and policy sizes to suit their particular needs. Manufacturers can choose the number of head, weight variety, coverage cost, and coverage period that straighten with their manufacturing objectives and risk resistance. Understanding these adjustable alternatives is essential for producers to effectively handle their rate danger exposure.

Furthermore, LRP is offered for different livestock types, consisting of livestock, swine, and lamb, making it a functional threat administration tool for animals manufacturers across various industries. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make informed decisions to secure their investments and guarantee financial stability when faced with market unpredictabilities

Benefits of LRP Insurance Coverage for Animals Producers

Animals producers leveraging Animals Risk Defense (LRP) Insurance obtain a critical benefit in shielding their investments from rate volatility and safeguarding a secure monetary footing in the middle of market unpredictabilities. One key benefit of LRP Insurance policy is cost protection. By establishing a flooring on the price of their animals, manufacturers can mitigate the threat of significant monetary losses in the event of market slumps. This permits them to prepare their spending plans more efficiently and make informed decisions regarding their operations without the continuous concern of price variations.

Additionally, LRP Insurance coverage provides producers with comfort. Understanding that their investments are protected against unanticipated market modifications permits manufacturers to concentrate on various other facets of their company, such as enhancing pet wellness and well-being or maximizing manufacturing procedures. This satisfaction can bring about increased performance and productivity in the lengthy run, as producers can run with more confidence and security. On the whole, the benefits of LRP Insurance for livestock producers are substantial, using an important device for taking care of threat and making certain economic safety and security in an unforeseeable market setting.

Exactly How LRP Insurance Mitigates Market Risks

Alleviating market dangers, Animals Threat Security (LRP) Insurance policy provides livestock producers with a reputable shield versus price volatility and financial unpredictabilities. By supplying security against unanticipated cost drops, LRP Insurance assists producers safeguard their financial investments and maintain financial stability in the face of market fluctuations. This kind of insurance coverage permits livestock manufacturers to lock in a cost for their animals at the start of the policy period, making sure a minimum cost level no matter market modifications.

Steps to Secure Your Animals Investment With LRP

In the world of farming danger administration, executing Livestock Risk Defense (LRP) Insurance policy includes a critical process to safeguard investments against market variations and unpredictabilities. To secure your animals investment properly with LRP, the initial action is to analyze the specific threats your procedure faces, such as cost volatility or unforeseen weather occasions. Recognizing these risks permits you to determine the coverage level required to protect your investment appropriately. Next, it is crucial to study and select a reputable insurance policy supplier that supplies LRP plans customized to your animals and service requirements. Thoroughly examine the policy terms, conditions, and coverage limitations to guarantee they straighten with your threat monitoring objectives as soon as you have chosen a provider. In addition, on a regular basis checking market patterns and adjusting your protection as required can help optimize your security versus possible losses. By complying with these actions diligently, you can enhance the safety of your animals investment and browse market unpredictabilities with confidence.

Long-Term Financial Protection With LRP Insurance Policy

Ensuring enduring monetary stability through the application of Livestock Threat Security (LRP) Insurance is a prudent long-term strategy for farming producers. By including LRP Insurance policy into their threat monitoring strategies, farmers can guard their animals investments versus unforeseen market changes and negative events that might threaten their financial well-being in time.

One trick advantage of LRP Insurance coverage for long-lasting monetary protection is the assurance it provides. With a reliable insurance coverage in place, farmers can mitigate the economic dangers connected with unpredictable market conditions and unanticipated losses due to factors such as disease break outs or natural disasters - Bagley Risk Management. This security allows manufacturers to concentrate on the daily procedures of their livestock company without constant bother with prospective monetary problems

Furthermore, LRP Insurance policy provides an organized technique to managing threat over the long term. By setting details protection levels and choosing suitable recommendation periods, farmers can tailor their insurance policy plans to straighten with their monetary objectives and risk best site resistance, making sure a sustainable and safe and secure future for their livestock procedures. Finally, spending in LRP Insurance coverage is a positive strategy for farming producers helpful hints to achieve long lasting economic security and safeguard their livelihoods.

Final Thought

In final thought, Livestock Risk Security (LRP) Insurance is a useful device for livestock manufacturers to minimize market risks and protect their financial investments. By understanding the advantages of LRP insurance policy and taking steps to apply it, producers can attain lasting economic safety and security for their operations. LRP insurance policy provides a safeguard against rate fluctuations and makes sure a degree of stability in an uncertain market atmosphere. It is a sensible selection for guarding animals financial investments.

Report this page